by Dan Mitchell

Two weeks ago, I shared some video from a presentation to the New Economic School of Georgia (the country, not the state) as part of my “Primer on the Laffer Curve.”

Here’s that portion of that presentation that outlines the principles of sensible taxation.

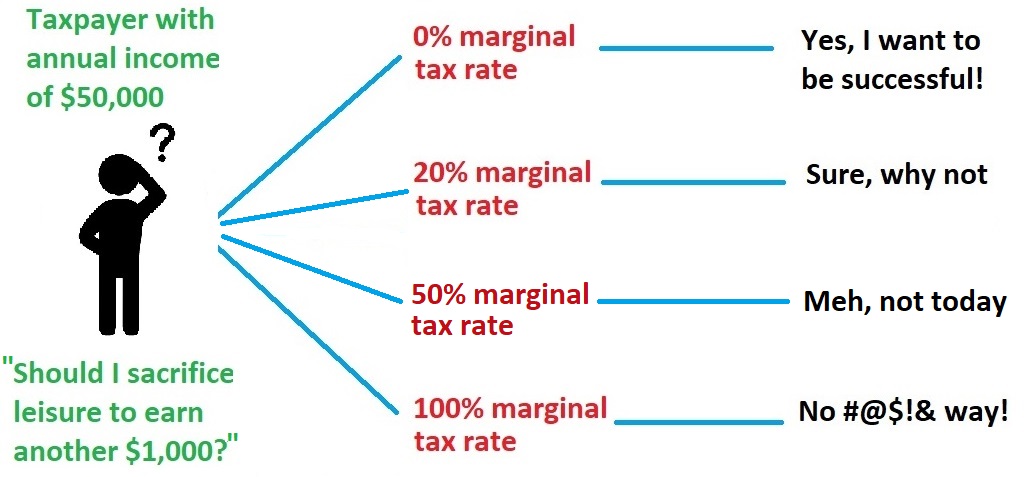

Just in case you don’t want to watch me pontificate for nearly 14 minutes, here’s the slide from the presentation that most deserves attention since it captures the key principle of good tax policy.

Simply stated, the more you tax of something, the less you get of that thing.

By the way, I had an opportunity earlier this year to share some similar thoughts about the principles of sound tax policy with the United Nations’ High-Level Panel on Financial Accountability Transparency & Integrity.

Given my past interactions with fiscal people at the U.N., I’m not overflowing with optimism that the following observations with have an impact, but hope springs eternal.

The ideal fiscal environment is one that has a vibrant and productive economy that generates sufficient revenue with modest tax rates that do not needlessly penalize productive behavior. Public finance experts generally agree on the following features

- Low marginal tax rates. A tax operates by increasing the “price” of whatever is being taxed. This is most obvious in the case of some excise taxes –such as levies on tobacco –where governments explicitly seek to discourage certain behaviors. …but there should be a general consensus in favor of keeping tax rates reasonable on the behaviors –work, saving, investment, risk-taking, and entrepreneurship –that make an economy more prosperous.

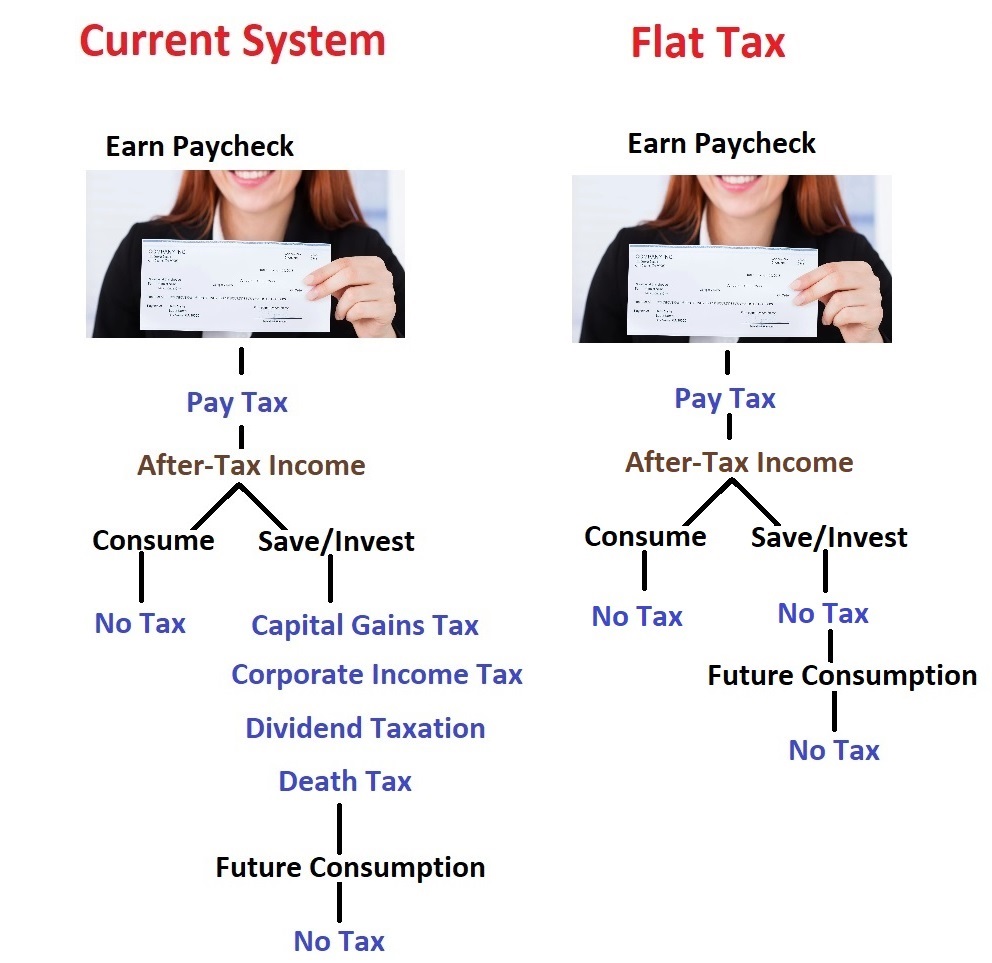

- A “consumption-base.” Because of capital gains taxes, death taxes, wealth taxes, and double taxation of interest and dividends, many nations impose a disproportionately harsh tax burden on income that is saved and invested. This creates a bias against capital formation, which is problematical since every economic theory –including various forms of socialism –share the view that saving and investment are necessary for rising wages and higher living standards.

- Neutrality. Special preferences in a tax system distort the relative “prices” of how income is earned or how income is spent. Such special tax breaks encourage taxpayers to make economically inefficient choices simply to lower their tax liabilities. Moreover, loopholes, credits, deductions, exemptions, holidays, exclusions, and other preferences reduce tax receipts, thus creating pressure for higher marginal tax rates, which magnifies the adverse economic impact.

- Territoriality. This is the simple notion that governments should not tax activity outside their borders. If income is earned in Brazil, for instance, the Brazilian government should have the authority over how that income is taxed.The same should be true for all other nations.

By the way, “consumption-base” is simply the jargon used by public-finance economistswhen referring to a tax system that doesn’t impose double taxation (i.e., extra layers of tax on income that is saved and invested).

Here’s a flowchart I prepared showing the double taxation in the current system compared to what happens with a flat tax.

P.S. At the risk of understatement, it’s impossible to have a good tax system with a bloated public sector, which means it’s not easy to be optimistic about future fiscal policyin the United States.

Daniel J. Mitchell is a public policy economist in Washington. He’s been a Senior Fellow at the Cato Institute, a Senior Fellow at the Heritage Foundation, an economist for Senator Bob Packwood and the Senate Finance Committee, and a Director of Tax and Budget Policy at Citizens for a Sound Economy. His articles can be found in such publications as the Wall Street Journal, New York Times, Investor’s Business Daily, and Washington Times. Mitchell holds bachelor’s and master’s degrees in economics from the University of Georgia and a Ph.D. in economics from George Mason University. Original article can be viewed here.

Self-Reliance Central publishes a variety of perspectives. Nothing written here is to be construed as representing the views of SRC.